All Categories

Featured

There is no one-size-fits-all when it comes to life insurance./ wp-end-tag > In your hectic life, economic self-reliance can appear like a difficult goal.

Pension, social protection, and whatever they would certainly handled to conserve. But it's not that very easy today. Fewer companies are providing traditional pension and lots of firms have minimized or stopped their retirement and your ability to count exclusively on social safety and security remains in question. Even if benefits have not been reduced by the time you retire, social protection alone was never intended to be adequate to pay for the lifestyle you desire and should have.

/ wp-end-tag > As component of an audio monetary approach, an indexed global life insurance coverage policy can aid

you take on whatever the future brings. Before devoting to indexed global life insurance coverage, here are some pros and disadvantages to take into consideration. If you select a good indexed global life insurance coverage plan, you may see your cash money value expand in worth.

Veterans Universal Life Insurance

Because indexed global life insurance policy calls for a specific level of risk, insurance firms often tend to keep 6. This type of strategy likewise supplies.

If the chosen index doesn't execute well, your cash worth's growth will be impacted. Normally, the insurer has a beneficial interest in doing much better than the index11. However, there is generally an assured minimum rates of interest, so your plan's growth will not drop listed below a particular percentage12. These are all aspects to be considered when choosing the very best kind of life insurance policy for you.

Are Iul A Good Investment

Because this kind of policy is extra intricate and has an investment component, it can typically come with higher costs than various other policies like entire life or term life insurance coverage. If you don't assume indexed global life insurance is ideal for you, here are some options to consider: Term life insurance is a short-lived plan that commonly provides coverage for 10 to 30 years.

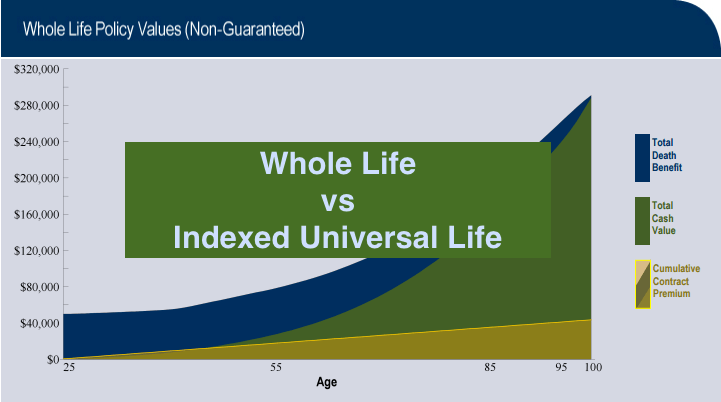

When determining whether indexed global life insurance policy is right for you, it is very important to consider all your choices. Entire life insurance policy might be a better option if you are trying to find more stability and uniformity. On the other hand, term life insurance policy might be a far better fit if you just need coverage for a specific time period. Indexed universal life insurance policy is a kind of policy that uses more control and flexibility, in addition to higher cash money value growth possibility. While we do not provide indexed global life insurance policy, we can give you with more information regarding entire and term life insurance plans. We suggest checking out all your options and talking with an Aflac agent to uncover the very best suitable for you and your family members.

The remainder is added to the cash money value of the policy after costs are deducted. While IUL insurance coverage may confirm beneficial to some, it's important to comprehend how it functions before purchasing a policy.

Latest Posts

Indexed Variable Universal Life Insurance

Tax Free Retirement Iul

Universal Index Life Insurance Pros And Cons